Today we will talk about the best credit card sign-up bonuses of 2026. I know that I am always curious about the sign-up bonuses of credit cards, and knowing which credit cards can give you the most benefit can be very useful for you.

If you are thinking of applying for a new credit card, then this guide is important for you. I have prepared this list based on my personal experiences and research. My aim is to show you the best options and help you choose the right card that is most beneficial for you.

I remember when I got my first credit card, I was very confused about which card to get. But after some research and with the help of experts, I chose a card that was perfect for me. So, without further delay, let’s get started!

Top 10 Best Credit Card Sign-Up Bonuses

Choosing a credit card is a very important decision, and it can be even more beneficial for you if you get the right sign-up bonuses. Here I have listed the top 10 credit cards of 2026 that offer the best sign-up bonuses. With these, you can earn maximum rewards on your travel, dining and daily expenses.

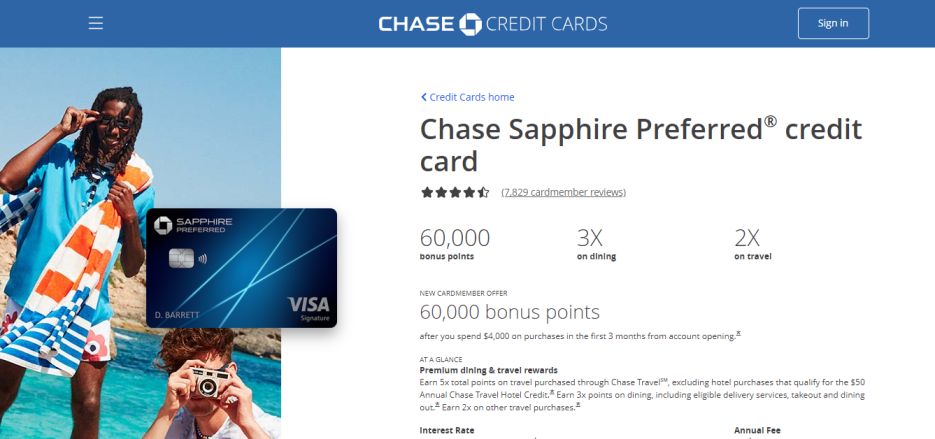

1. Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card is an excellent option if you spend on travel and dining. This card’s sign-up bonus offer can earn you up to 60,000 points when you spend $4,000 in your first 3 months. You can redeem these points on travel and dining purchases.

| Feature | Details |

|---|---|

| Sign-Up Bonus | 60,000 points |

| Annual Fee | $95 |

| APR | 20.49% – 27.49% Variable |

| Foreign Transaction Fees | None |

Pros:

- 2x points on travel and dining

- 1 point per dollar on all other purchases

- No foreign transaction fees

- Flexible redemption options through Chase Ultimate Rewards

Cons:

- Points value varies depending on redemption

- $95 annual fee

- High APR

- Requires good to excellent credit

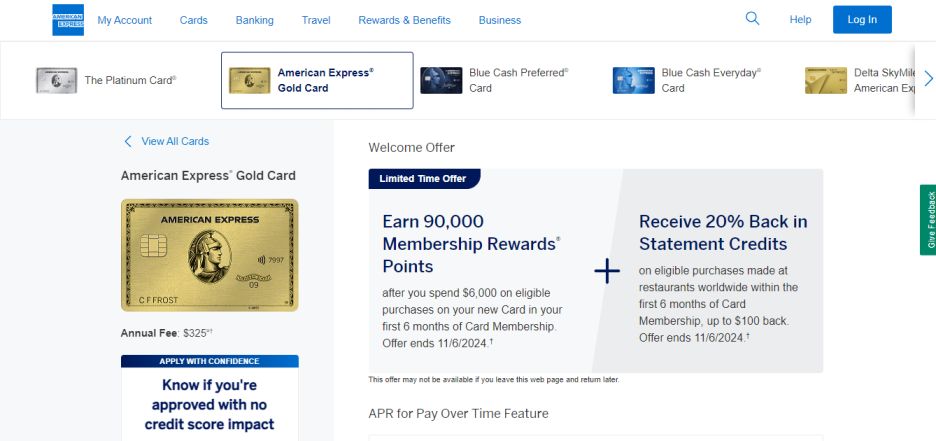

2. American Express Gold Card

The American Express Gold Card is also a great option for travel and dining. You can earn 60,000 Membership Rewards® points if you spend $4,000 in the first 6 months. This card also gives you rewards at grocery stores and dining.

| Feature | Details |

|---|---|

| Sign-Up Bonus | 60,000 Membership Rewards® points |

| Annual Fee | $250 |

| APR | 20.24% – 27.24% Variable |

| Foreign Transaction Fees | None |

Pros:

- 4x points at restaurants, including takeout and delivery

- 4x points at U.S. supermarkets (on up to $25,000 per year in purchases, then 1x)

- 3x points on flights booked directly with airlines or on amextravel.com

- Monthly dining credits

Cons:

- $250 annual fee

- High APR

- Limited acceptance outside the U.S.

- Points value can vary

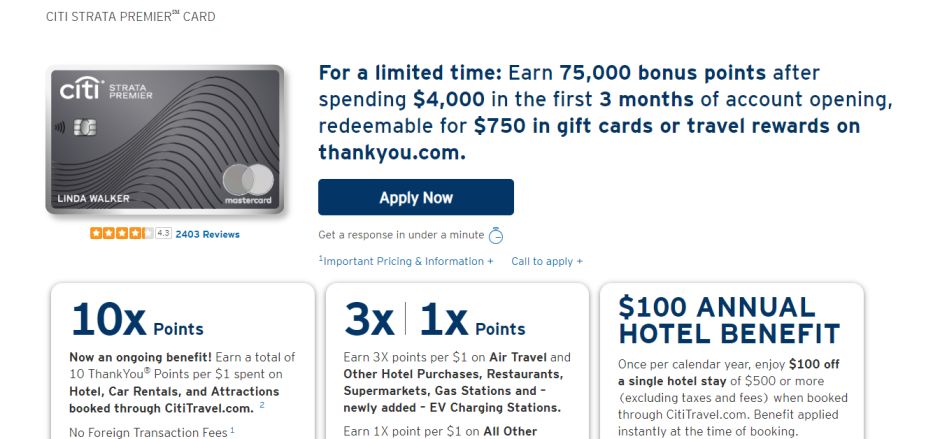

3. Citi Premier Card

The Citi Premier Card is great for people who want to earn maximum rewards from their daily spending. This card’s sign-up bonus offer can earn you 80,000 points if you spend $4,000 in the first 3 months.

| Feature | Details |

|---|---|

| Sign-Up Bonus | 80,000 points |

| Annual Fee | $95 |

| APR | 20.49% – 28.49% Variable |

| Foreign Transaction Fees | None |

Pros:

- 3x points on air travel, hotels, and gas stations

- 3x points on restaurants and supermarkets

- 1x points on all other purchases

- No foreign transaction fees

Cons:

- $95 annual fee

- Rewards program can be complex

- High APR

- Requires good to excellent credit

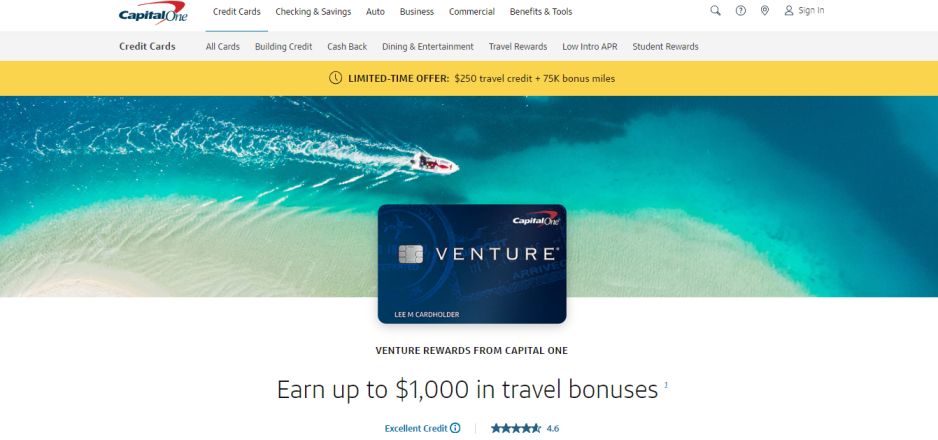

4. Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is another great option if you are a frequent traveler. This card can earn you 75,000 miles if you spend $4,000 in the first 3 months.

| Feature | Details |

|---|---|

| Sign-Up Bonus | 75,000 miles |

| Annual Fee | $95 |

| APR | 20.74% – 28.74% Variable |

| Foreign Transaction Fees | None |

Pros:

- 2x miles on every purchase

- Transfer miles to over 15 travel loyalty programs

- No foreign transaction fees

- Flexible redemption options

Cons:

- $95 annual fee

- High APR

- Requires good to excellent credit

- Miles value can vary

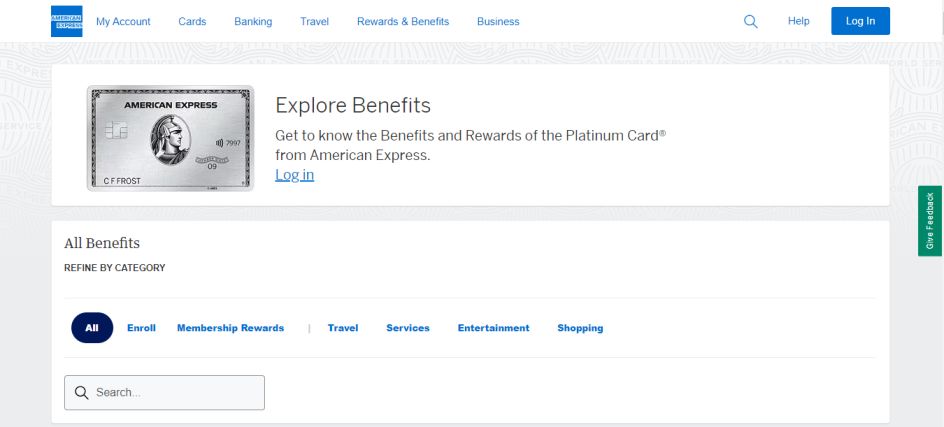

5. The Platinum Card from American Express: Premium Travel Benefits

The Platinum Card from American Express is a perfect card for luxury travelers. You can get 100,000 Membership Rewards® points if you spend $6,000 in the first 6 months.

| Feature | Details |

|---|---|

| Sign-Up Bonus | 100,000 Membership Rewards® points |

| Annual Fee | $695 |

| APR | See Pay Over Time APR |

| Foreign Transaction Fees | None |

Pros:

- 5x points on flights booked directly with airlines or with American Express Travel

- 5x points on prepaid hotels booked with American Express Travel

- Access to over 1,200 airport lounges worldwide

- Extensive travel and purchase protections

Cons:

- $695 annual fee

- High spending requirement for bonus

- Limited acceptance outside the U.S.

- High APR

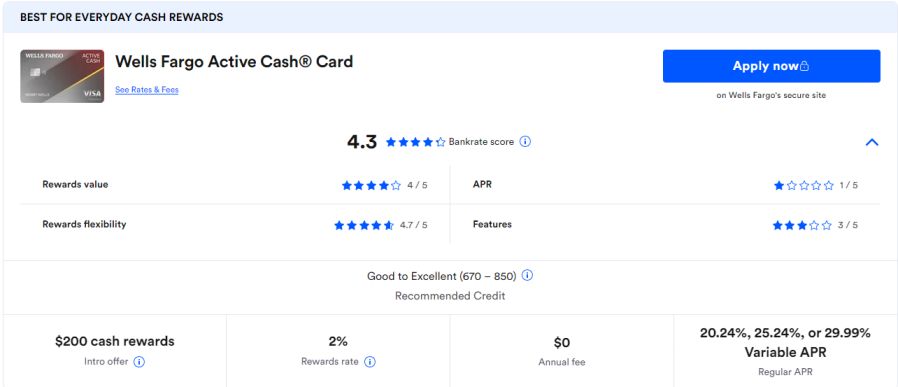

6. Wells Fargo Active Cash Card: Straightforward Cash Rewards

The Wells Fargo Active Cash Card is for people who prefer no-fuss cash rewards. You can get $200 cash rewards if you spend $1,000 in the first 3 months.

| Feature | Details |

|---|---|

| Sign-Up Bonus | $200 cash rewards |

| Annual Fee | $0 |

| APR | 19.99% – 29.99% Variable |

| Foreign Transaction Fees | 3% |

Pros:

- Unlimited 2% cash rewards on purchases

- No annual fee

- Introductory APR on purchases and qualifying balance transfers

- Simple rewards structure

Cons:

- 3% foreign transaction fee

- High APR

- No bonus categories for higher rewards

- Limited travel benefits

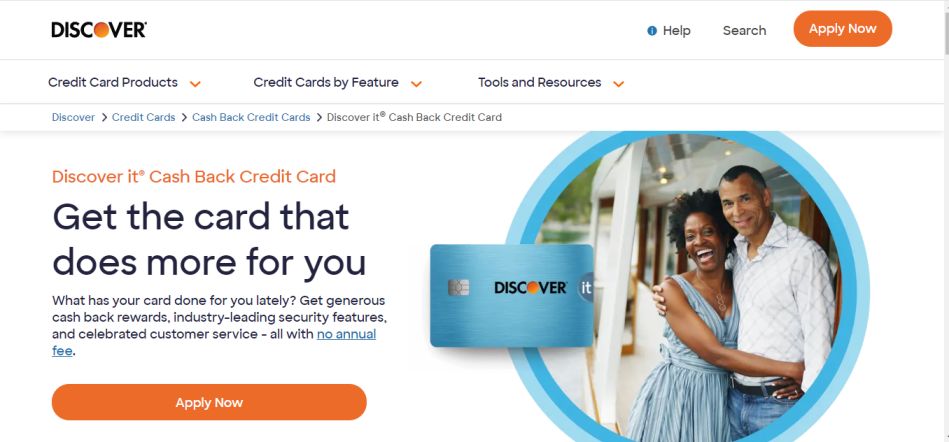

7. Discover it Cash Back: Unique Cashback Match

Discover it Cash Back is a unique option as its sign-up bonus offers a Cashback Match, where Discover matches your first year’s cashback earned.

| Feature | Details |

|---|---|

| Sign-Up Bonus | Cashback Match |

| Annual Fee | $0 |

| APR | 16.49% – 27.49% Variable |

| Foreign Transaction Fees | None |

Pros:

- 5% cashback on rotating categories each quarter (up to the quarterly maximum, then 1%)

- 1% cashback on all other purchases

- No annual fee

- No foreign transaction fees

Cons:

- Categories need activation

- Quarterly maximum on bonus categories

- High APR

- Limited acceptance outside the U.S.

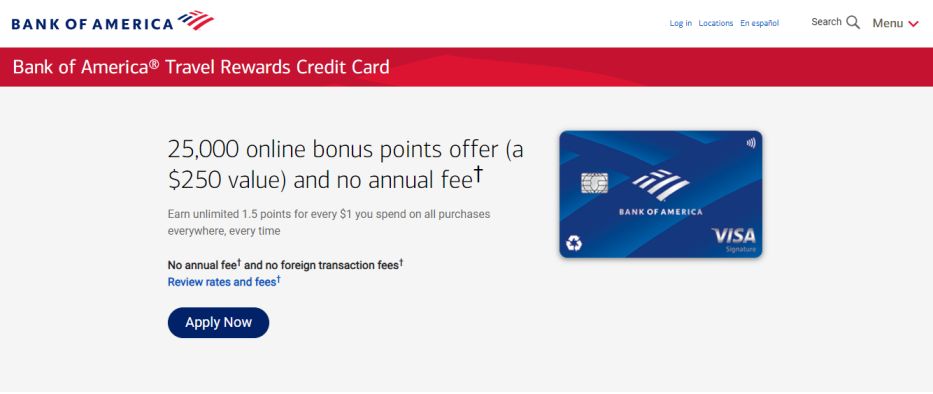

8. Bank of America Travel Rewards Credit Card: Simple Travel Points

The Bank of America Travel Rewards Credit Card is a great option for travel enthusiasts. You can get up to 25,000 online bonus points if you spend $1,000 in the first 3 months.

| Feature | Details |

|---|---|

| Sign-Up Bonus | 25,000 online bonus points |

| Annual Fee | $0 |

| APR | 17.49% – 27.49% Variable |

| Foreign Transaction Fees | None |

Pros:

- Unlimited 1.5 points per $1 spent on all purchases

- No annual fee

- No foreign transaction fees

- Easy-to-redeem points for travel

Cons:

- Lower sign-up bonus compared to other travel cards

- High APR

- Requires good to excellent credit

- Limited travel perks

9. Hilton Honors American Express Surpass Card: High Hilton Rewards

The Hilton Honors American Express Surpass Card is best for people who stay at Hilton hotels. You can get 130,000 Hilton Honors Bonus Points if you spend $2,000 in the first 3 months.

| Feature | Details |

|---|---|

| Sign-Up Bonus | 130,000 Hilton Honors Bonus Points |

| Annual Fee | $95 |

| APR | 20.24% – 29.24% Variable |

| Foreign Transaction Fees | None |

Pros:

- 12x points on Hilton purchases

- 6x points on U.S. restaurants, U.S. supermarkets, and U.S. gas stations

- 3x points on all other purchases

- Complimentary Hilton Honors Gold status

Cons:

- $95 annual fee

- High APR

- Limited to Hilton properties

- Points can have limited value outside of Hilton stays

10. Marriott Bonvoy Boundless Credit Card: Exceptional Marriott Rewards

The Marriott Bonvoy Boundless Credit Card is an excellent option for Marriott loyalists. You can get 100,000 Bonus Points if you spend $3,000 in the first 3 months.

| Feature | Details |

|---|---|

| Sign-Up Bonus | 100,000 Bonus Points |

| Annual Fee | $95 |

| APR | 20.99% – 27.99% Variable |

| Foreign Transaction Fees | None |

Pros:

- 6x points at participating Marriott Bonvoy hotels

- 2x points on all other purchases

- Free Night Award every anniversary

- No foreign transaction fees

Cons:

- $95 annual fee

- High APR

- Limited to Marriott properties

- Points value can vary depending on redemption

Conclusion

I hope this list will help you choose your next credit card. Every credit card has its own pros and cons, and you should choose the best option according to your spending habits and preferences.

When I chose my first credit card, I did a lot of research and took advice from experts. Similarly, you can also choose the best card according to your needs. If you liked this article, please share it and share your experiences in the comments. Your feedback will help us provide even better content.

FAQs

What is the $750 welcome bonus credit card?

The $750 welcome bonus credit card generally refers to the Chase Sapphire Preferred Card. This card offers a sign-up bonus of 60,000 points, which can be worth up to $750 when you redeem them for travel through the Chase Ultimate Rewards portal. It’s a fantastic deal if you’re planning some travel soon!

What is the #1 credit card to have?

Choosing the #1 credit card really depends on your needs, but a lot of people swear by the Chase Sapphire Preferred Card. It’s popular because it offers versatile rewards, a hefty sign-up bonus, and great benefits for travelers. I personally find it really valuable for the points I earn on dining and travel.

What credit card will give you the most money?

If you’re looking to maximize the money you get from a sign-up bonus, the Citi Premier Card is a top contender. It offers a whopping 80,000 points as a sign-up bonus, which can translate to a lot of value when you redeem them for travel or other rewards.

How to get a $50,000 credit limit?

Getting a $50,000 credit limit isn’t easy, but it’s possible with a few steps. You’ll need an excellent credit score (usually 750 or above), a high annual income, and a strong credit history. Applying for premium credit cards and keeping your credit utilization low can also boost your chances. It takes some time and discipline, but it’s definitely achievable.

What is the easiest high limit credit card to get?

If you’re looking for an easy-to-get high limit card, the Capital One Venture Rewards Credit Card is a great option. Many people find the approval process straightforward, and it tends to offer generous credit limits for those with good to excellent credit. It’s a solid choice if you want a high limit without too much hassle.