Hello everyone, welcome to this article! Today we are going to talk about an app that is very useful for people living in the UAE, especially when you need money urgently. We will discuss CashNow, which is a mobile cash loan app, and how this app provides you with instant cash loans with low interest rates and fast approval. This guide will be helpful for you if you are in the UAE and looking for quick financial assistance.

I believe that in today’s time, people have less time, and financial emergencies can arise at any moment. In such situations, loan apps like CashNow become very important because they provide you with loans quickly and easily without much paperwork. I have done my own research, and I will explain all these points so that you can understand how this app works and how it can benefit you.

1. CashNow: What is this App?

CashNow is a mobile cash loan app that provides you with instant loans within the UAE. The main feature of the app is that you only need your Emirates ID and a valid mobile number, and you can receive money directly into your bank account within a few hours! Isn’t that simple? CashNow is specially designed for those seeking financial assistance; no matter your nationality, if you are a resident of the UAE, you can use it.

App Features:

| Feature | Description |

|---|---|

| Instant Loans | Quick approval and disbursement of cash loans. |

| Flexible Terms | Repayment options between 91 to 180 days. |

| User-Friendly | Easy navigation and minimal documentation required. |

| Secure | Personal data encrypted for safety. |

| Accessible | Open for all UAE residents regardless of nationality. |

2. How to Get a Loan?

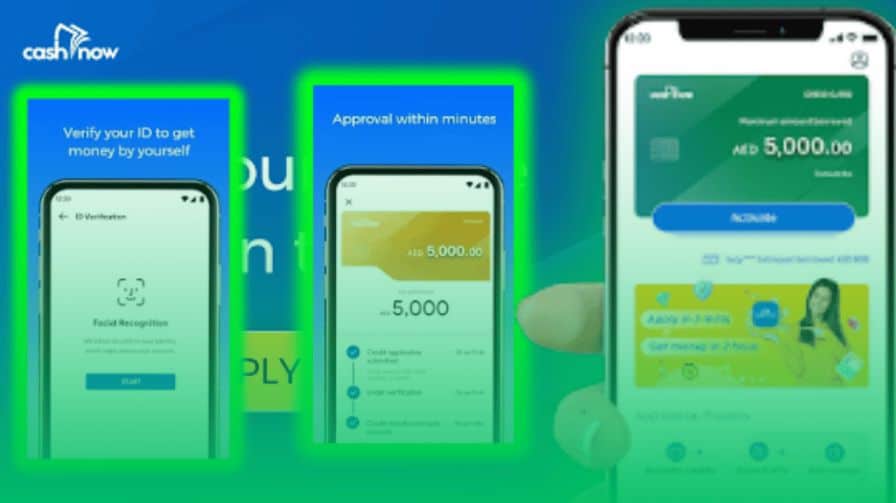

Getting a loan through the CashNow app is incredibly easy and designed to be user-friendly. I will walk you through the process step-by-step, so you can see just how simple it is to get the financial help you need. Let’s break it down:

Step 1: Download the CashNow App

The first thing you need to do is download the CashNow app. You can find it on the Google Play Store or the App Store. Just search for “CashNow – Mobile Cash Loan App” and click on the download button. The app is lightweight, so it won’t take up much space on your device.

Step 2: Sign Up with Your Emirates ID

Once the app is downloaded, open it and begin the sign-up process. You will need to enter your Emirates ID and a valid mobile number. This information is crucial as it verifies your identity and helps the app understand that you are a resident of the UAE.

Don’t worry; the app will guide you through this step. Just make sure to enter the details correctly to avoid any issues later on.

Step 3: Apply for the Loan

After signing up, you can start your loan application. The app will provide a user-friendly interface that will guide you step-by-step. You will need to fill in some details about your financial situation, including your income and expenses. This information helps the app assess your eligibility for a loan.

One important part of this step is to verify your bank account. The app may ask for some additional details like your bank account number to ensure that the money is transferred to the right place. This step is essential for security reasons, and it helps protect you from fraud.

Step 4: Instant Approval & Transfer

Once you have submitted your application, the magic happens! If all your documents are correct and your information checks out, you will receive instant approval for your loan. This means you don’t have to wait days or even weeks like traditional banks.

After approval, the money will be transferred directly to your bank account or digital wallet within just a few hours. Isn’t that great? You can then use the funds for whatever you need, whether it’s paying bills, handling emergencies, or even making a big purchase.

A Quick Summary:

- Download the CashNow app from the Play Store or App Store.

- Sign up using your Emirates ID and mobile number.

- Apply for the loan and verify your bank account.

- Receive instant approval and get your money transferred quickly!

With these simple steps, you can access cash whenever you need it without the usual hassle of traditional loan processes. CashNow makes it easy to manage your finances and gives you peace of mind in emergencies.

Google Play Store Details

| Detail | Description |

|---|---|

| App Name | CashNow – Mobile Cash Loan App |

| Developer | Quantix Technology Projects LLC |

| Downloads | 1M+ |

| Rating | 4.6/5 (as of October 2024) |

| Download Size | 51.12 MB |

| Current Version | 1.16.1 |

| Last Updated | Aug 11, 2024 |

| Link | Download from Play Store |

3. Loan Amount and Repayment Terms

Now the question arises about how much loan you can take and how long you will have to repay it?

| Loan Amount | Repayment Term | Interest Rate | Processing Fee |

|---|---|---|---|

| AED 500 – AED 10,000 | 91-180 days | 25% per year | 5% of loan amount |

This table clearly shows that you can take a loan ranging from AED 500 to AED 10,000, depending on your credit score and eligibility. You need to repay the loan within 91 to 180 days, which is flexible according to your budget. The interest rate is 25% per year, which is quite competitive. There is also a 5% processing fee deducted from the loan amount.

For example, if you take a loan of AED 3,000 for 180 days:

- Monthly payment: AED 562.50

- Interest amount: AED 375.00

- Processing fee: AED 150.00

- Total repayment: AED 3,375.00

- APR (Annual Percentage Rate): 35%

4. Key Benefits of Using CashNow

In my opinion, there are some important benefits of the CashNow app that make it unique compared to other loan apps:

- Instant Loan Disbursement: As I mentioned earlier, the loan process is fast, and you get money within a few hours.

- Low Interest Rates: The 25% per year interest rate is quite reasonable, lower than many other loan providers.

- No Paperwork Hassle: You only need your Emirates ID and mobile number.

- Secure Process: Your data is secure, and you need to verify your identity via a selfie.

- Accessible to All Nationalities: If you are a UAE resident, no matter your nationality, you can apply for this loan.

Additional Benefits:

| Benefit | Description |

|---|---|

| 24/7 Availability | Loan applications can be submitted anytime. |

| Easy Tracking | Track your loan status in real-time through the app. |

| Loyalty Rewards | Get rewarded for timely payments with discounts on fees. |

| Personalized Offers | Receive customized loan offers based on your repayment history. |

5. Repayment Process

Repayment is also easy and flexible, allowing you to adjust according to your financial plan. The 91 to 180 days repayment terms mean that you can pay back according to your budget.

If your monthly income fluctuates, you will find these flexible terms helpful. Many other loan providers have fixed tenure and strict repayment policies, which may not be suitable for everyone.

Repayment Methods:

| Method | Details |

|---|---|

| Bank Transfer | Direct transfer from your bank account. |

| Credit/Debit Card | Use your card to make payments online. |

| Mobile Wallets | Payment through popular wallets like PayPal and Google Pay. |

6. Secure and Safe to Use

Nowadays, privacy and security have become major concerns, especially when using online loan apps. The CashNow app encrypts your personal data and financial information, and you only need to verify your identity with your selfie and documents, making it a secure process. I found this quite impressive because everything is digital, and I didn’t need any paperwork or offline verification.

Security Features:

| Feature | Description |

|---|---|

| Data Encryption | User data is encrypted for security. |

| Two-Factor Authentication | Additional security layer during login. |

| Regular Audits | Regular security audits to ensure app safety. |

7. Customer Support and Contact Details

If you have any issues or questions, you can connect with them through the app. Their customer care team is very helpful, and you can get assistance via WhatsApp or Email.

| Contact Method | Details |

|---|---|

| [email protected] | |

| +971 50 123 4567 | |

| Working Hours | 24/7 |

8. Conclusion

So friends, CashNow is a reliable and user-friendly loan app that provides you with instant cash loans with low interest rates. The app’s flexibility and easy process allow you to easily deal with financial emergencies. You only need your Emirates ID and valid mobile number, and you can receive money within a few hours.

If you need money, CashNow could be your best option. Its repayment plan is also tailored to your financial goals, giving you control over your expenses.

Top 5 FAQs for CashNow – Mobile Cash Loan App

1. What are the eligibility requirements to apply for a loan?

To apply for a loan through the CashNow app, you must meet the following eligibility criteria:

- Be a UAE resident.

- Hold a valid Emirates ID.

- Have a personal bank account in one of the supported banks.

- Be between the ages of 20 and 55.

2. How long does it take to get approved for a loan?

The approval process for loans with CashNow is fast. Once you have submitted your application with all required documents, you can expect to receive instant approval within a few minutes. If your information is accurate, the funds can be transferred to your bank account within a few hours.

3. What loan amounts can I apply for?

With CashNow, you can borrow amounts ranging from AED 500 to AED 10,000. The amount you qualify for will depend on your credit score and repayment capacity, which is assessed during the application process.

4. What are the interest rates and repayment terms?

CashNow offers flexible repayment terms. The normal interest rate is 25% per year, with a 5% processing fee deducted from the loan amount. You can choose a repayment period between 91 to 180 days, based on what fits your budget.

5. Is my personal information safe with CashNow?

Yes, CashNow prioritizes the security and privacy of its users. The app requires you to verify your identity through a selfie and secure your information using encryption. Your personal details will not be shared with third parties without your consent.

I hope you found this article helpful and that you will benefit from this information. If you have any further questions or need more details, please feel free to leave a comment below.

Finally, whenever you need money, make sure to try the CashNow app and share your experiences! Thank you!