Hello everyone, welcome to our detailed review of CIBC Investor’s Edge! If you are looking for a reliable and cost-effective trading platform, CIBC Investor’s Edge can be an excellent choice. This Canadian online discount brokerage platform provides investors with advanced tools and low-cost trading options. In this article, I am going to tell you in detail about the features, benefits, and fees of this platform.

This guide will help you make your investment decisions informed and confident. Let’s explore the key aspects of CIBC Investor’s Edge!

Introduction

CIBC Investor’s Edge is a prominent discount brokerage in Canada under the Canadian Imperial Bank of Commerce (CIBC). This platform offers investors low-cost trading options along with comprehensive research tools and various account types. This review is based on my own experience and research, where I will explain all the features, pros and cons, fee structure, and everything related to CIBC Investor’s Edge in detail.

CIBC Investor’s Edge Overview

CIBC Investor’s Edge is a leading online discount brokerage in Canada, providing investors with low-cost trading options, advanced tools, and research facilities. This platform is ideal for those who want to manage their investments themselves without high fees. Through CIBC Investor’s Edge, you can invest in financial instruments like stocks, ETFs, mutual funds, bonds, and GICs. In this review, I will detail all the key features, benefits, fees, and pros and cons of this platform so you can make an informed decision.

What is CIBC Investor’s Edge?

CIBC Investor’s Edge is an online discount brokerage service that allows you to trade various types of investments like stocks, ETFs (Exchange-Traded Funds), mutual funds, bonds, and GICs (Guaranteed Investment Certificates). This platform is best for investors who want to do self-directed investing and manage their portfolio independently.

This service gives you complete control over your investments, where you can use research tools to make informed decisions. A special feature of CIBC Investor’s Edge is that it provides low-cost trading fees along with extensive research tools and market data.

Features and Benefits of CIBC Investor’s Edge

If you are considering managing your investments on your own, CIBC Investor’s Edge could be a very valuable tool for you. This platform offers comprehensive research tools, low-cost trading, and a user-friendly interface, providing you with the flexibility to manage your portfolio effectively. Whether you are a beginner or an experienced investor, the diverse features and benefits of CIBC Investor’s Edge are designed to make your trading journey seamless and efficient. In this section, I will explain all the major features and benefits, which will help enhance your investing experience.

If you want to use CIBC Investor’s Edge, here are some important features you should definitely know about:

1. Customer Support:

CIBC Investor’s Edge also excels in customer support. You receive 24/7 support through phone, email, and online chat. From personal experience, I can say that their response time and quality of customer service are quite impressive.

2. Low-Cost Trading:

The biggest benefit of CIBC Investor’s Edge is its low-cost trading structure. You can execute equity trades for just $6.95 per trade, which is quite competitive in the Canadian market. This low fee structure makes it ideal for both beginners and experienced investors.

3. Comprehensive Research Tools:

CIBC Investor’s Edge offers advanced research tools and analytics to help you understand market trends and make informed investment decisions. These tools include:

- Stock Screeners: You can screen stocks according to your preferences.

- Market News: Real-time news updates keep you informed about the latest market happenings.

- Technical Analysis: In-depth charts and data assist you in performing technical analysis of stock performance.

- Fundamental Analysis: Access to financial statements and ratios helps you assess a company’s health and profitability.

4. Multiple Account Types:

CIBC Investor’s Edge offers a variety of account types, allowing you to choose an account based on your financial goals. These accounts include:

- Registered Retirement Savings Plan (RRSP): Save for retirement in a tax-advantaged manner.

- Tax-Free Savings Account (TFSA): Your investments grow tax-free.

- Registered Education Savings Plan (RESP): Save for your children’s education.

- Non-Registered Accounts: General investment accounts that are flexible and accessible.

5. Dividend Reinvestment Plans (DRIPs):

The DRIP feature of CIBC Investor’s Edge allows you to automatically reinvest dividend payments, helping to compound your returns. This feature is particularly beneficial for long-term investors.

Fees and Charges of CIBC Investor’s Edge

Understanding the fees and charges is a crucial factor when selecting any brokerage platform. It is important to have a detailed understanding of the fees structure of CIBC Investor’s Edge so that you can manage your costs effectively.

Fees Structure Overview

Below is a table that summarizes the major fees and charges of CIBC Investor’s Edge:

| Fees Type | Charges |

|---|---|

| Equity Trades | $6.95 per trade |

| ETF Trades | $6.95 per trade |

| Mutual Fund Trades | No commission |

| Options Trades | $6.95 + $1.25 per contract |

| Annual Account Fee | $100 (Waived for balances over $10,000) |

| Inactivity Fee | $25 per quarter (Waived with regular trading) |

| Transfer-Out Fee | $135 per account |

| Wire Transfer Fee | $10 for domestic, $30 for international transfers |

Equity Trades

For equity trades, CIBC Investor’s Edge charges $6.95 per trade, which is reasonable by discount brokerage standards. This fee is ideal for experienced traders who trade frequently.

ETF Trades

ETF trades are also priced at $6.95 per trade. ETFs have become quite popular among investors today because they offer diversified exposure and low management fees.

Mutual Fund Trades

CIBC Investor’s Edge charges no commission for mutual fund trades, making the platform attractive to investors looking to diversify their portfolio without incurring additional trading costs.

Options Trades

For options trading, you need to pay $6.95 plus $1.25 per contract. Options trading is an advanced strategy suitable for experienced traders, and this fee is competitive for them.

Annual Account Fee

The annual account fee is $100; however, this fee is waived if your account balance exceeds $10,000. To avoid this fee, you can maintain your account balance or engage in regular trading.

Inactivity Fee

The inactivity fee is $25 per quarter if your account remains inactive. However, this fee is waived if you engage in regular trading or if your account balance exceeds the threshold.

Pros and Cons: Advantages and Disadvantages of CIBC Investor’s Edge

Like every investment platform, CIBC Investor’s Edge has its own set of pros and cons. Let’s examine them in detail.

Pros

- Low-Cost Trading Fees: The trading fee structure of CIBC Investor’s Edge is quite competitive, making it cost-effective.

- Comprehensive Research Tools: Advanced research tools and market data help you make informed decisions.

- Multiple Account Types: Various account types are available based on different financial goals, providing flexibility and convenience.

- Strong Customer Support: 24/7 customer support assists you in resolving queries and issues.

- DRIP Feature: Dividend Reinvestment Plans allow you to automatically reinvest dividends, generating compound returns.

Cons

- Limited Free Trades: While some brokers offer free trades, CIBC Investor’s Edge does not have this option.

- Complex Interface: The platform’s interface may be somewhat complex for beginners, which could be intimidating.

- Inactivity Fees: Inactivity fees can be problematic if you do not trade regularly.

- Transfer-Out Fee: The transfer-out fee is relatively high, which could be costly when closing an account.

How to Get Started with CIBC Investor’s Edge

If you want to open an account with CIBC Investor’s Edge, this step-by-step guide will help you understand the entire process. Let’s get started:

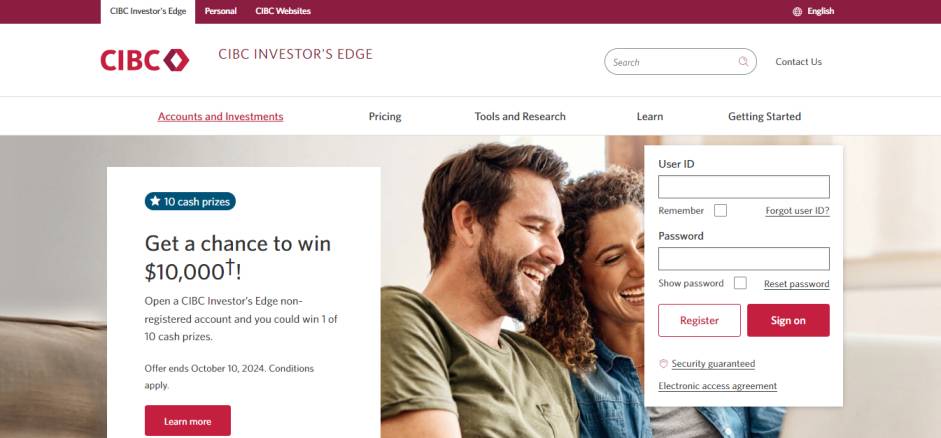

Visit the Website:

First, open CIBC Investor’s Edge’s official website on your computer or mobile device. Once on the website, you will see a button labeled “Open an Account” or “Sign Up.” Click this button to start the account opening process.

Select Account Type:

The next step is to choose an account type based on your financial goals. CIBC Investor’s Edge offers various types of accounts, such as RRSP (for retirement savings), TFSA (Tax-Free Savings Account), and Non-Registered accounts (for general investing). If you’re unsure, do some research or contact customer service to select the right account type for you.

Fill Out the Form:

After selecting your account type, you will need to complete an application form. This form is straightforward and requires basic information such as your name, address, date of birth, and financial details (income, employment status, etc.). Fill out the form carefully and accurately to avoid any issues later.

Submit Identification:

CIBC Investor’s Edge will need some documents to verify your identity. You will need to upload a copy of your driver’s license, passport, or another government-issued ID. This step is crucial to ensure your account remains safe and secure.

Fund Your Account:

Once your form and identification are approved, you will need to deposit funds into your account. You can do this through online banking, wire transfer, or by check. Enter the amount you wish to invest and make the deposit. Once the deposit is processed, your funds will be ready for trading.

Start Trading:

Finally, when your account is funded, you can begin trading. You can invest in stocks, ETFs, mutual funds, and other financial instruments. The user-friendly interface of CIBC Investor’s Edge will help you navigate the platform easily. If you need guidance at any point, you can refer to the platform’s tutorials or seek assistance from customer support.

Conclusion

CIBC Investor’s Edge is a platform that can be highly useful for investors seeking low-cost trading options and comprehensive research tools. It offers full control over your investments, along with flexibility and convenience. However, before using it, make sure to consider its pros and cons in light of your financial goals.

I hope this review has been helpful and has provided you with a thorough understanding of CIBC Investor’s Edge. If you have any questions or feedback, please feel free to share them in the comments section!

FAQ

What is CIBC Investor’s Edge?

CIBC Investor’s Edge is a Canadian online discount brokerage platform that offers low-cost trading options and advanced research tools. This platform allows investors to invest in stocks, ETFs, mutual funds, and bonds, helping them achieve their financial goals.

How long does it take to open an account with CIBC Investor’s Edge?

Opening an account with CIBC Investor’s Edge generally takes a few days. After completing the application process, there may be some time needed to verify your identification documents. Once your account is approved, you can start trading.

Are there trading fees on CIBC Investor’s Edge?

Yes, CIBC Investor’s Edge has trading fees that vary depending on your account type and trading volume. Generally, the platform offers low-cost trading options, helping investors avoid high fees.

How is the mobile app for CIBC Investor’s Edge?

The CIBC Investor’s Edge mobile app is user-friendly and feature-rich. Through this app, you can manage your investments, execute trades, and receive real-time market updates, no matter where you are.

Does CIBC Investor’s Edge provide customer support?

Yes, CIBC Investor’s Edge offers excellent customer support. You can contact customer service via phone, email, or online chat. Their team helps promptly resolve your queries and issues.