Nowadays, financial emergencies can arise at any time. Whether you are facing medical expenses or need funds for a business investment, there are moments when you urgently need money. I personally experienced this a few months ago when I needed cash quickly. I turned to the RING app and received an instant loan. In this article, I will explain the complete process of obtaining a loan through the RING app, including eligibility criteria, interest rates, repayment options, and some personal tips.

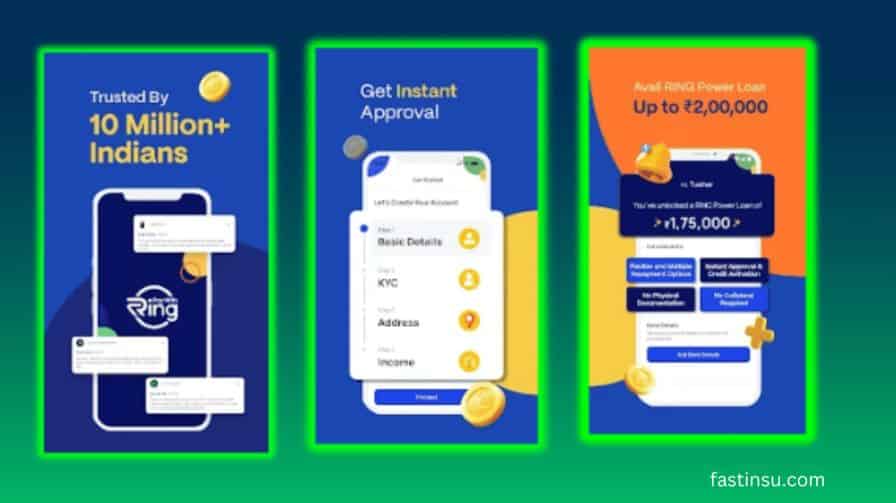

What is the RING App?

The RING app is an instant loan and UPI payment app that offers quick loans and seamless UPI transactions. By using this app, you can borrow amounts ranging from ₹30,000 to ₹5 lakh. The KYC process takes only 5 minutes, making it even more convenient. When I used this app, I found it to be incredibly user-friendly.

Features of the RING App

| Feature | Description |

|---|---|

| Instant Loan Approval | Instant loan approval takes only 5 minutes. |

| Loan Amount | You can borrow from ₹30,000 to ₹5,00,000. |

| Flexible Repayment | Repayment options range from 3 to 24 months. |

| UPI Transactions | Send money to any bank account or mobile number via UPI. |

| Transparent Fees | No hidden charges; everything is completely transparent. |

Eligibility Criteria for RING App Loan

To get a loan from the RING app, there are certain eligibility criteria you should consider. These criteria are essential for determining your loan eligibility.

| Criteria | Description |

|---|---|

| Age | You should be between 21 and 58 years old. |

| Income | Your monthly income should be ₹15,000 or more. |

| Employment | You should be either salaried or self-employed. |

| KYC Documentation | You need to provide valid identification and address proof. |

I found these eligibility criteria quite easy to meet. When I used the app, I only needed to upload a photo of my Aadhar card and a utility bill, which was sufficient. This made the loan process hassle-free.

Interest Rates and Charges

The interest rates and charges for loans taken through the RING app are as follows. I personally found these charges to be quite transparent.

| Description | Rate/Charge |

|---|---|

| Interest Rate | 18% to 36% per annum |

| Processing Fee | 3% of loan amount (including GST) |

| Total Interest for ₹1,00,000 Loan | ₹16,985 (1 year tenure) |

| EMI | ₹9,747 per month |

| Total Repayment Amount | ₹1,16,985 |

When I took the loan, I found these charges to be transparent and easy to understand. I always consider these charges for financial planning so that I know how much I need to repay. Additionally, I found the interest rate competitive, which motivated me to use the app even more.

How to Apply for a Loan Using RING App

Getting a loan from the RING app is a simple and hassle-free experience. The entire process is designed to be user-friendly, allowing you to access funds quickly when you need them the most. Here’s a detailed breakdown of what I did to secure my loan:

1. Download the App

The first step in my journey was to download the RING app from the Play Store. The app is lightweight and installs quickly on my smartphone. I appreciated how easy it was to find the app and get started.

2. Sign Up

After installation, I opened the app and proceeded to sign up using my mobile number. This step requires you to verify your number through an OTP (One-Time Password) sent to your phone. This added layer of security made me feel more comfortable about using the app.

3. KYC Process

Next came the KYC (Know Your Customer) process, which is essential for any loan application. I had to upload clear photos of my identification and address proof. In my case, I chose to upload my Aadhar card along with a recent utility bill. This process was straightforward, and I appreciated the app’s guidance on what documents were needed.

4. Select Loan Amount

Once my KYC was completed, I moved on to select the loan amount I needed. The app provides a user-friendly interface to help you choose the amount based on your financial requirements. I found this feature particularly useful as it allowed me to assess how much I could comfortably repay.

5. Submit Your Application

With everything in place, I was ready to submit my loan application. I hit the submit button and waited for approval. To my surprise, I received approval in just 5 minutes! This was quite impressive and alleviated any anxiety I had about waiting for a long time.

Reflecting on the entire process, I remember thinking how seamless and efficient it was. I honestly didn’t expect approval to be so quick, but the RING app exceeded my expectations. From downloading the app to receiving the loan approval, everything flowed smoothly, making it a stress-free experience for me.

Repayment Options

Repayment of loans via the RING app is quite flexible. You can select your EMI from options ranging from 3 to 24 months. This flexibility allows you to plan according to your budget.

EMI Calculation Example

| Loan Amount (Principal) | Tenure (Months) | Interest Rate | Processing Fee | Total Interest | EMI | Total Repayment |

|---|---|---|---|---|---|---|

| ₹1,00,000 | 12 | 30% | ₹3,000 | ₹16,985 | ₹9,747 | ₹1,16,985 |

This table helps you understand how your total repayment amount and EMI are calculated. When I saw this table, I figured out how much loan I could take according to my budget.

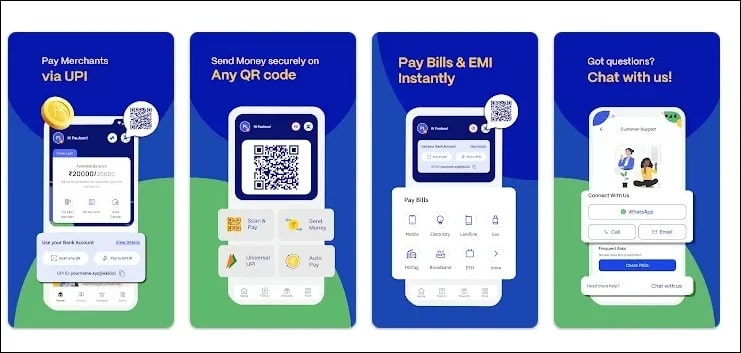

UPI Transactions with RING

The RING UPI feature allows you to send and receive money easily. I’ve used UPI transactions myself and found them very convenient.

UPI Transaction Features

| Feature | Description |

|---|---|

| Instant Transfers | Send money instantly to any bank account or mobile number. |

| UPI Lite Transactions | Small transactions up to ₹200 without any hassle. |

| Payment Tracking | Track your bills and EMI payments. |

I appreciate that the RING app interface for UPI transactions is user-friendly. I can transfer money anytime and anywhere. Additionally, there are no hidden fees for UPI transactions, which makes this app even better.

Customer Support and Safety

The RING app takes customer safety seriously. Their policies and customer service practices are quite transparent. My own experience was positive.

Customer Support Policies

| Policy | Description |

|---|---|

| Registered Communication | Calls are made only from registered landlines. |

| No Personal Accounts | No payments are made to personal or private bank accounts. |

| Call Monitoring | All calls are tracked and recorded. |

If you face any issues, you can follow these steps:

- Email or Call: You can write to [email protected] or call the customer care number at 08044745880 / 08062816300.

- Share Screenshots or Recordings: Share screenshots or recordings of your messages or calls.

Their address is: Office units 2, 3, and 4, 10th Floor, Tower 4, Equinox Park, LBS Marg, Kurla (West), Mumbai -400070, Maharashtra, India.

Disclaimer: The RING app is SSL-certified, and all transactions are 100% safe and secure.

Personal Experience

I remember needing to do some financial planning to manage my expenses. I looked at my monthly budget to decide how much loan I needed. After that, I applied on the app, and once I received approval, I used the funds for my essential expenses.

Conclusion

The RING app is a convenient and user-friendly platform that provides instant loans and UPI transactions. Its eligibility criteria, interest rates, and repayment options are flexible, making it suitable for everyone. I have personally used this app and found it very easy to navigate.

If you ever find yourself in need of funds, I recommend using the RING app. The process is so seamless that you won’t face any issues obtaining a loan. With a little financial planning and an understanding of the app’s policies, you can easily benefit from it.

I hope this article helps you in using the RING app. If you have any more questions, feel free to write in the comment section; I’m here to help!

FAQs

What are the eligibility criteria for taking a loan with the RING App?

To take a loan from the RING app, you must be between the ages of 21 and 58, have a monthly income of ₹15,000 or more, and be either salaried or self-employed. KYC documents such as an Aadhaar card and address proof are required.

What is the interest rate on loans through the RING App?

The interest rate on loans from the RING app ranges from 18% to 36% per annum. Additionally, there is a processing fee of 3% applied to the loan amount.

How long does the loan approval process take on the RING App?

The loan approval process on the RING app takes only 5 minutes, making it very convenient. You just need to upload your documents and wait for the approval.

How is the loan repayment done on the RING App?

Loan repayment on the RING app can be done with flexible options ranging from 3 to 24 months. You can select an EMI according to your budget, and each month’s EMI is automatically deducted.

How are UPI transactions conducted on the RING App?

To conduct UPI transactions on the RING app, you need to link your bank account within the app. After that, you can instantly transfer money to any bank account or mobile number. There are no hidden fees for UPI transactions.